250k

Get instant freight rate levels for 250.000+ routes!

CFR Matrix

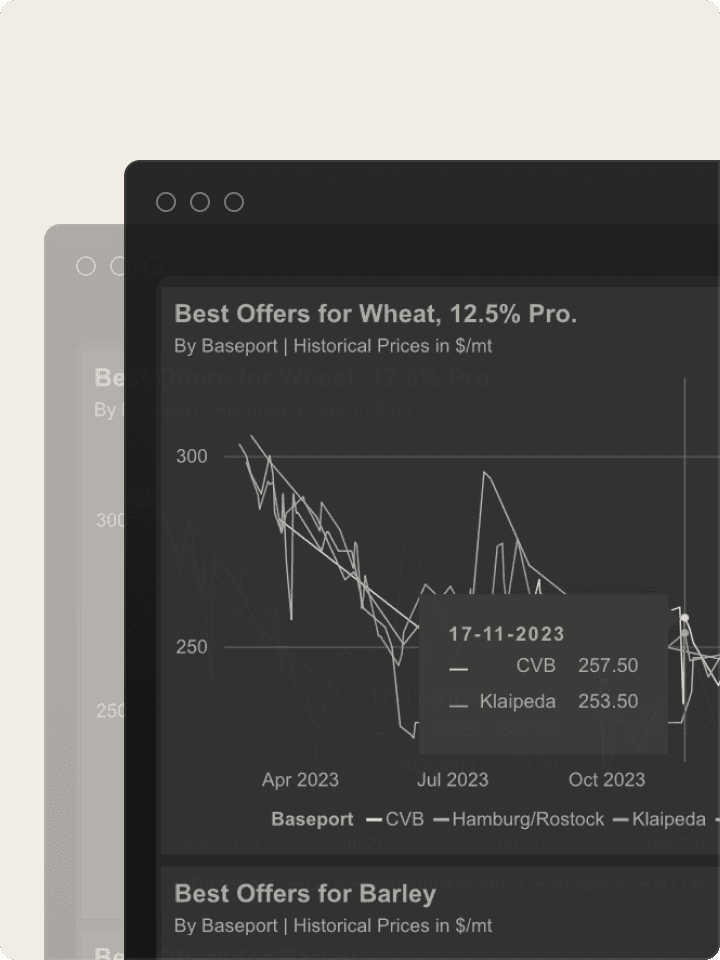

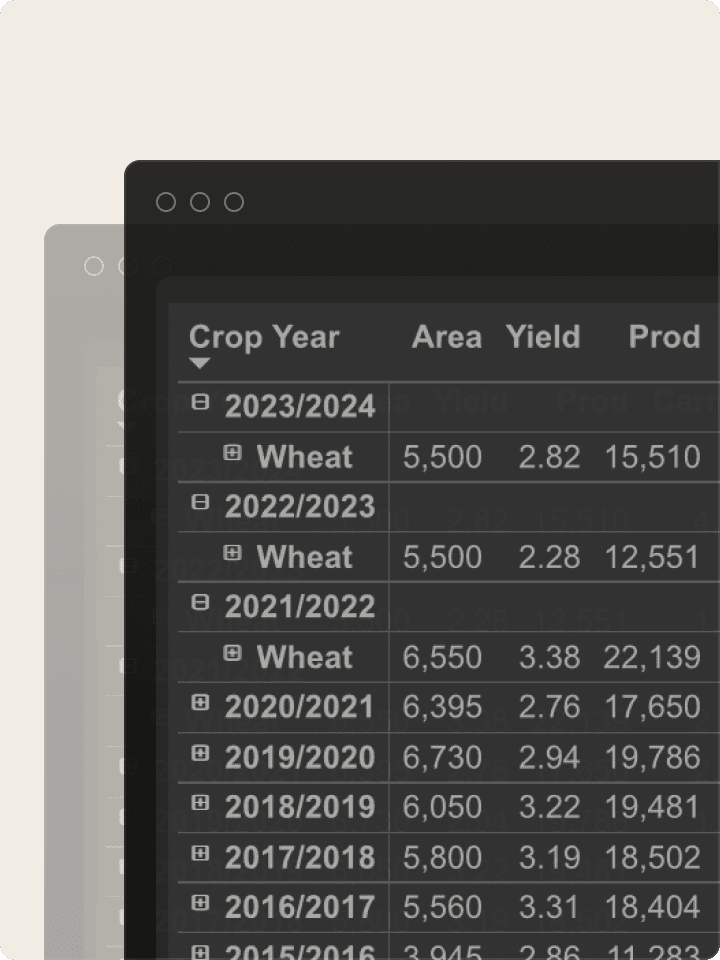

The complete CFR overview

With access to 3500 CFR prices across 590 destination ports, our CFR matrix empowers you to identify the optimal trading opportunities. By integrating our dataset of market prices with our vast amount of global freight rates, we have tailored a simple overview enabling you to compare origin competitiveness quickly.

Get started today - Trade with an edge!

Step 1

Start a trial - no commitment

Your time is valuable! We have made it simple and easy for you to try out CM Navigator for free or get a demo. No strings attached.

Step 2

Experience immediate value

The full potential of your trading game is now unlocked. Try out the full platform during your trial and experience the feeling of having the market at your fingertips.

Step 3

Stay in the lead

Be in the best position to compete with up-to-date; CFR Prices, Freights, Market Prices, Supply & Demand, Trade Flows, Funds Positions and Market Reports.

Explore Market Information

Commodities

Agri- Commodities:

26-30/01/26 Agri

Feb 02, 2026

Prices started the week lower across the board, led by US wheat. Weather-risk fears that pushed prices higher late last week eased, as winterkill damage is historically difficult to evaluate and often fades quickly from focus. CBOT weakness came despite further USD softening, suggesting the prior rally had been stretched.

Freight

Freight Recap:

29/01/26

Jan 29, 2026

The market carried a more constructive tone this week, but it was still shaped by winter operating conditions and selective demand rather than broad-based strength. Weather disruption in the North Atlantic created short-lived tightness and pockets of spot demand, while the Pacific remained more subdued and generally unchanged. Overall, activity was steady, but charterers were more measured, and owners with prompt positions were less willing to chase cargo aggressively.

Interview

Mads Frank Markussen on Sparta Market Outlook Podcast

Feb 12, 2025

Mads and the Sparta team explored the impact of Trump’s tariffs, sanctions, and market inefficiencies on oil and freight trading, as well as how tariffs on Mexico, Canada, and China could reshape trade flows—discussed

“CM Navigator is not just a data provider, they provide real-world insights and expertise! We really experience their proximity to the actual markets, within both freight and commodities – prices are always accurate and updated. It has increased our agility to respond to market shifts and make smarter decisions faster!”

Axel Walle

Trader, Lantmännen, Sweden