250k

Get instant freight rate levels for 250.000+ routes!

CFR Matrix

The complete CFR overview

With access to 3500 CFR prices across 590 destination ports, our CFR matrix empowers you to identify the optimal trading opportunities. By integrating our dataset of market prices with our vast amount of global freight rates, we have tailored a simple overview enabling you to compare origin competitiveness quickly.

Get started today - Trade with an edge!

Step 1

Start a trial - no commitment

Your time is valuable! We have made it simple and easy for you to try out CM Navigator for free or get a demo. No strings attached.

Step 2

Experience immediate value

The full potential of your trading game is now unlocked. Try out the full platform during your trial and experience the feeling of having the market at your fingertips.

Step 3

Stay in the lead

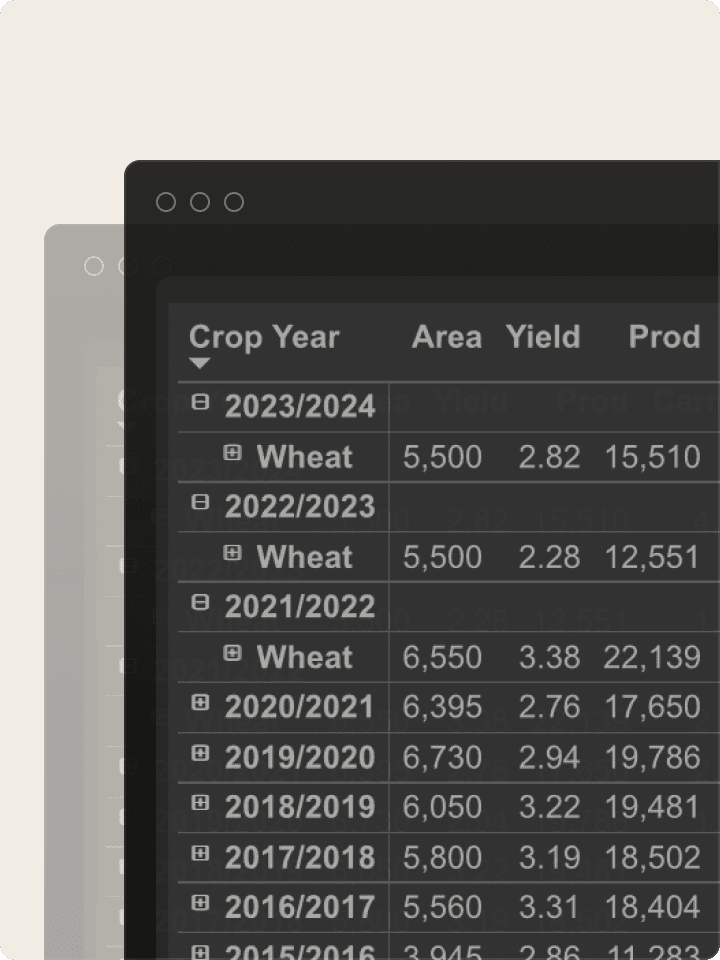

Be in the best position to compete with up-to-date; CFR Prices, Freights, Market Prices, Supply & Demand, Trade Flows, Funds Positions and Market Reports.

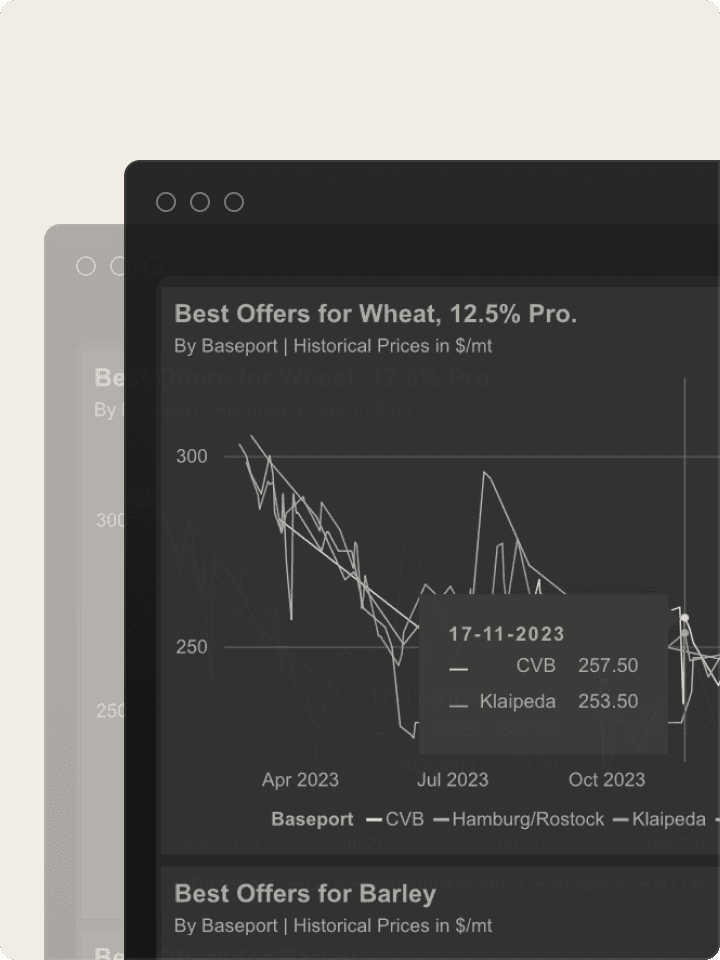

Explore Market Information

Commodities

Agri- Commodities:

02-06/03/26 Agri

Mar 09, 2026

Grain markets started the week with strength, briefly pushing wheat and soybeans to new multi-month highs before quickly reversing. Chicago wheat failed to hold above the key $6 level and sold off sharply as the dollar strengthened and U.S. equities recovered. The rapid turnaround highlighted the unstable environment, with volatility remaining the dominant feature as the Middle East conflict continues to shape broader market sentiment.

Freight

Freight Recap:

03/03/26

Mar 05, 2026

Dry bulk sentiment stayed mixed this week. The larger sizes cooled slightly after a strong run, but the geared segments held a firmer tone and Panamax continued to show a clear Atlantic versus Pacific split. Activity levels were decent, yet the market is still being steered by regional positioning, prompt list tightness, and a heavier ris

Interview

Mads Frank Markussen on Sparta Market Outlook Podcast

Feb 12, 2025

Mads and the Sparta team explored the impact of Trump’s tariffs, sanctions, and market inefficiencies on oil and freight trading, as well as how tariffs on Mexico, Canada, and China could reshape trade flows—discussed

“CM Navigator is not just a data provider, they provide real-world insights and expertise! We really experience their proximity to the actual markets, within both freight and commodities – prices are always accurate and updated. It has increased our agility to respond to market shifts and make smarter decisions faster!”

Axel Walle

Trader, Lantmännen, Sweden