Articles & News

Weekly Recaps

Commodities

Agri- Commodities:

26-30/01/26 Agri

Feb 02, 2026

Prices started the week lower across the board, led by US wheat. Weather-risk fears that pushed prices higher late last week eased, as winterkill damage is historically difficult to evaluate and often fades quickly from focus. CBOT weakness came despite further USD softening, suggesting the prior rally had been stretched.

Freight

Freight Recap:

29/01/26

Jan 29, 2026

The market carried a more constructive tone this week, but it was still shaped by winter operating conditions and selective demand rather than broad-based strength. Weather disruption in the North Atlantic created short-lived tightness and pockets of spot demand, while the Pacific remained more subdued and generally unchanged. Overall, activity was steady, but charterers were more measured, and owners with prompt positions were less willing to chase cargo aggressively.

Commodities

Agri- Commodities:

19-23/01/26 Agri

Jan 26, 2026

With the U.S. on holiday, Paris futures traded on their own and were fairly muted despite a stronger EUR/USD and limited EU participation in recent North African tenders. The MATIF wheat H/K carry continued to shrink as U.S. markets reopened largely unchanged. Trump said he may slap a 200% tariff on French wine and champagne, while also reiterating his intent to take control of Greenland.

Freight

Freight Recap:

22/01/26

Jan 15, 2026

Dry bulk freight markets strengthened across all major segments this week, driven by firmer demand, tightening tonnage lists, and improving sentiment. Rates trended higher in both basins, with momentum most visible in mid-sized vessels and growing spillover support from the Atlantic into the Pacific.

Latest Interviews

Interview

Augusto Abati

Jun 06, 2024

Will wheat planting be tough for Brazilian farmers? Listen to how we discuss about the current situation in Brazilian markets, the challenges faced by local farmers, conflicting corn crop estimates, and what all this means for prices.

Interview

Dan Basse - Part II

Apr 17, 2024

How could Russia's consolidation impact prices? In this interview, we discuss the growing influence of the Russian government in grain trading. We also discuss the global grain market and various factors such as demand, weather patterns, and the emergence of AI in trading strategies. We explore these questions further in an interview (part 2 of 2) with Dan Basse.

Interview

Dan Basse - Part I

Apr 15, 2024

Farmers across the world are facing an uphill battle – What is the difference between American and European farmers communities? Dive into the heart of the matter – as European farmers take to the streets in protest, American farmers face a different kind of struggle, with growing concerns about their mental health based on an/with an up tap/increase in farmers suicides across the US. Wondering what lies ahead? Is the bear market finally behind us/over? Gain insights from our exclusive interview with Dan Basse.

Interview

Nikolay Gorbochov - Part II

May 24, 2023

What is the potential impact the EU restrictions imposed on Ukrainian grain imports? We discuss whether these measures are temporary and highlight any reasons for EU farmers to express concerns. How critical it is to maintain a smooth flow of Ukrainian grain and what could be the potential impacts if grain exports were to halt. Additionally, alternative options to ensure the continuous movement of Ukrainian grain are discussed.

Latest Conference

Podcasts & Blogs

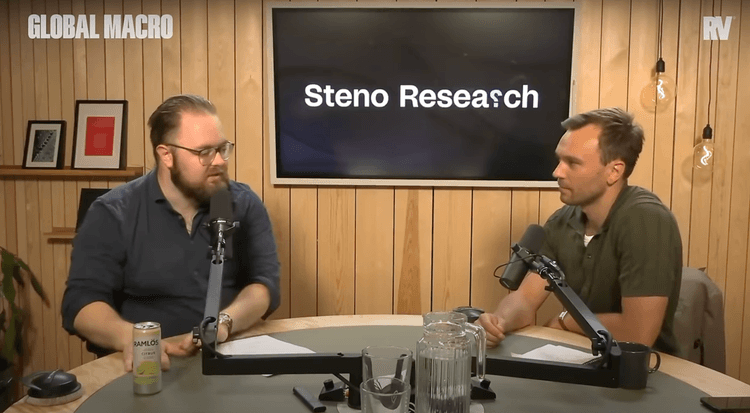

Interview

Marc Cochet Myllerup on Steno Research Podcast

Jul 02, 2024

Our colleague Marc Cochet Myllerup joined a conversation with Mikkel Rosenvold and Andreas Steno Larsen at Steno Research to discuss soybeans, corn, and wheat markets. His insights highlighted challenges such as reduced wheat yields in France and Russia, and India's increased wheat imports. Marc emphasized the crucial role of weather and geopolitical factors in commodity markets, offering practical insights. He also shared how using CM Navigator, an innovative research tool, enhances market prediction capabilities, providing valuable insights for making informed investment decisions.

Recent Articles

Article

Historical Data in Commodity Markets

Mar 15, 2024

In the complex world of commodity trading, the saying "history repeats itself" serves not merely as a philosophical thinking but as a foundational principle that supports investment and trading strategies. This is particularly relevant in...

Article

Increased Transparency in Dry Bulk Freight Markets

Feb 05, 2024

Shipping markets have traditionally been opaque and closed, controlled by relatively few market participants placed in locations far away from demand for freight services, e.g. Greece, Monaco or Denmark. Given that ship supply in ...

Article

Agricultural Supply and Demand Forecasting

Jan 02, 2024

In the global agricultural commodity markets, the ongoing ability to follow and forecast crop progress with accuracy is not just an advantage; it's a necessity to be able to compete. The interplay of multiple factors makes the ‘supply and demand dynamics’ complex...