Agricultural Supply and Demand Forecasting

Jan 02, 2024

By, Anders Valentin Vogt and Donatas Jankauskas

In the global agricultural commodity markets, the ongoing ability to follow and forecast crop progress with accuracy is not just an advantage; it's a necessity to be able to compete. The interplay of multiple factors makes the ‘supply and demand dynamics’ a complex exercise . This article touches upon how to leverage diverse and continuously updated data sourcesin supply and demand forecasting, with a focus on agricultural commodities, namely Wheat, Corn, Barley, and Soybeans.

Understanding Market Dynamics

The first step in mastering agricultural commodity forecasting is acknowledging the market's complexity. This complexity arises from a blend of environmental factors, economic policies, geopolitical events, and technological advancements that collectively influence supply and demand dynamics. Weather patterns directly impact agricultural productivity, while economic and geopolitical shifts can alter market access and affect global supply chains. Technological innovations continuously reshape production capabilities and efficiencies, introducing new variables into forecasting models. Moreover, market sentiment, driven by traders' perceptions, adds a layer of unpredictability. Understanding this complex web of factors is crucial for developing accurate forecasting assumptions. Volatility is not an exception but the norm, driven by an array of factors from unexpected weather events across the globe to sudden geopolitical conflicts. Navigating the volatility, applying a diverse selection of data sources is key for a comprehensive understanding of supply and demand dynamics.

Geopolitics and Volatility

The geopolitical landscape significantly impacts agricultural commodity prices, as evidenced by the recent Ukrainian / Russian war. This event spotlighted the fragility of global wheat supplies, given Ukraine's and Russia's role as major wheat exporters. The subsequent market disruption underscored the need for incorporating geopolitical analysis into market forecasting strategies. A responsive approach, leveraging real-time data on geopolitical events, enables market participants to anticipate and mitigate risks associated with such disruptions.

To demonstrate how unforeseen events can trigger volatility, the fluctuating wheat prices on the Chicago Board of Trade (CBOT) in 2022 are highlighting the market's susceptibility to geopolitical shocks. The chart below illustrates two notable surges in price during the first half of 2022, each a reaction to significant global events.

The initial surge of 50% corresponds to the outbreak of the Russian / Ukrainian war, with prices climbing sharply as one of the globe's largest grain-producing regions plunged into armed conflict. This sudden escalation reflected the market's anxiety over potential supply disruptions, triggering a spike as traders and other market participants rushed to close their short wheat positions amidst the uncertainty. The standard monthly deviation of CBOT wheat prices jumped more than 900% in March 2022.

A few months later India implemented a wheat export ban which led to another spike in prices. This move by a major global wheat supplier was a response to domestic concerns but had international repercussions, restricting global supply further and driving prices up as buyers competed for the remaining accessible wheat.

CBOT Wheat futures (daily continuous chart):

Source: CM Navigator

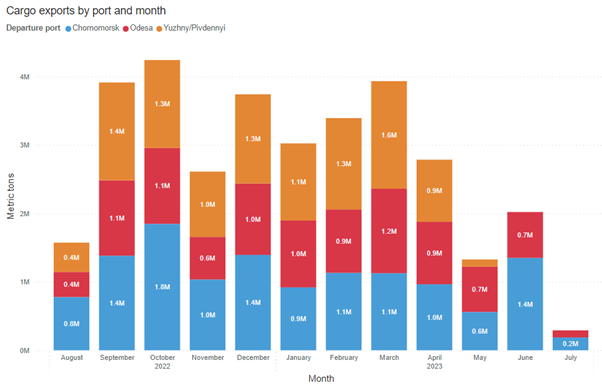

Following these spikes, a notable trend of price normalization occurred as grain began to flow out of Russia and Ukraine once more. This easing was partly due to the adaptation of export logistics, such as increased movement via rail and barges. However, the most substantial factor contributing to the price moderation was the establishment of the grain corridor. This agreement aimed to facilitate the safe passage of merchant vessels through the Black Sea, thus resuming exports from one of the world's key breadbasket regions. As shown in chart below, the restored flow from Ukraine relieved some of the acute supply pressures, gradually bringing prices down from their peaks as the market adjusted to the new status quo. These events also underscore the interrelation of global commodity markets and the potential for logistical adaptations and international agreements to stabilize markets even in the face of ongoing geopolitical strife.

Ukrainian agricultural exports through Black Sea Grain Initiative:

Source: https://www.un.org/en/black-sea-grain-initiative/data

Collecting diverse supply and demand reports

The unpredictable nature of agricultural markets, compounded by challenges such as local crop insights, data quality and model accuracy, calls for traders to use multiple sources of supply and demand forecasts to form a detailed picture they can rely on in their decision making.

Authoritative sources such as the OECD-FAO Agricultural Outlook provide valuable long-term insights into global agricultural trends. These comprehensive reports, which project future trends in production, consumption, and trade, are indispensable tools for anyone involved in agricultural commodity markets. However, it is worth to consider that authoritative sources may not provide the most timely predictions. Similarly, following regular updates from multiple trusted sources such as the United States Department of Agriculture (USDA), CM Navigator and StratégieGrains offer a diverse and detailed picture of supply and demand dynamics that traders can rely on in their decision making.

Conclusion

The future of agricultural commodity forecasting lies in the effective use of diverse data sources, from ground-level insights to global economic indicators. By embracing data-driven strategies, market participants can navigate the complexities of the global agricultural market with greater precision.

The difficulties of the agricultural commodity market demand a diverse approach to forecasting, one that integrates several data sources applying both fundamental analysis and the use of advanced analytical techniques. As the global landscape evolves, so too must the strategies of those who navigate these markets. Staying informed, adaptable, and data-driven will be key to thriving in the ever-changing world of agricultural commodities.

References

United Nations (2023). The Black Sea Grain Initiative: What was achieved? Why was it important? https://www.un.org/en/black-sea-grain-initiative/achievements

OECD/FAO (2023). OECD-FAO Agricultural Outlook 2023-2032, OECD Publishing, Paris/FAO, Rome https://www.oecd.org/publications/oecd-fao-agricultural-outlook-19991142.htm

Geneva Solutions (2022). Ukraine and Russia sign deal to create Black Sea corridor for grain exports https://genevasolutions.news/global-news/ukraine-and-russia-sign-deal-to-create-black-sea-corridor-for-grain-exports

University of Illinois Urbana-Champaign. (2024). How the Russian invasion of Ukraine has impacted the global wheat market. College of Agricultural, Consumer and Environmental Sciences News https://aces.illinois.edu/news https://aces.illinois.edu/news/how-russian-invasion-ukraine-has-impacted-global-wheat-market

U.S. Department of Agriculture. (2024). World Agricultural Supply and Demand Estimates (WASDE) https://www.usda.gov/oce/commodity/wasde

Recent Articles

Article

Historical Data in Commodity Markets

Mar 15, 2024

In the complex world of commodity trading, the saying "history repeats itself" serves not merely as a philosophical thinking but as a foundational principle that supports investment and trading strategies. This is particularly relevant in...

Article

Increased Transparency in Dry Bulk Freight Markets

Feb 05, 2024

Shipping markets have traditionally been opaque and closed, controlled by relatively few market participants placed in locations far away from demand for freight services, e.g. Greece, Monaco or Denmark. Given that ship supply in ...

Article

Agricultural Supply and Demand Forecasting

Jan 02, 2024

In the global agricultural commodity markets, the ongoing ability to follow and forecast crop progress with accuracy is not just an advantage; it's a necessity to be able to compete. The interplay of multiple factors makes the ‘supply and demand dynamics’ complex...