CFR Matrix

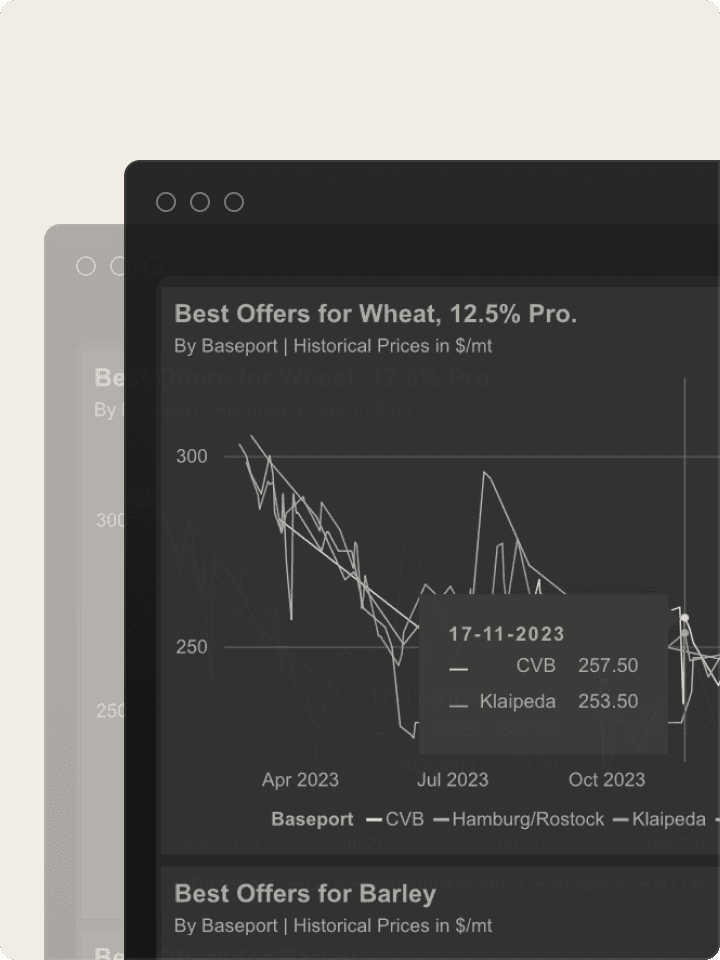

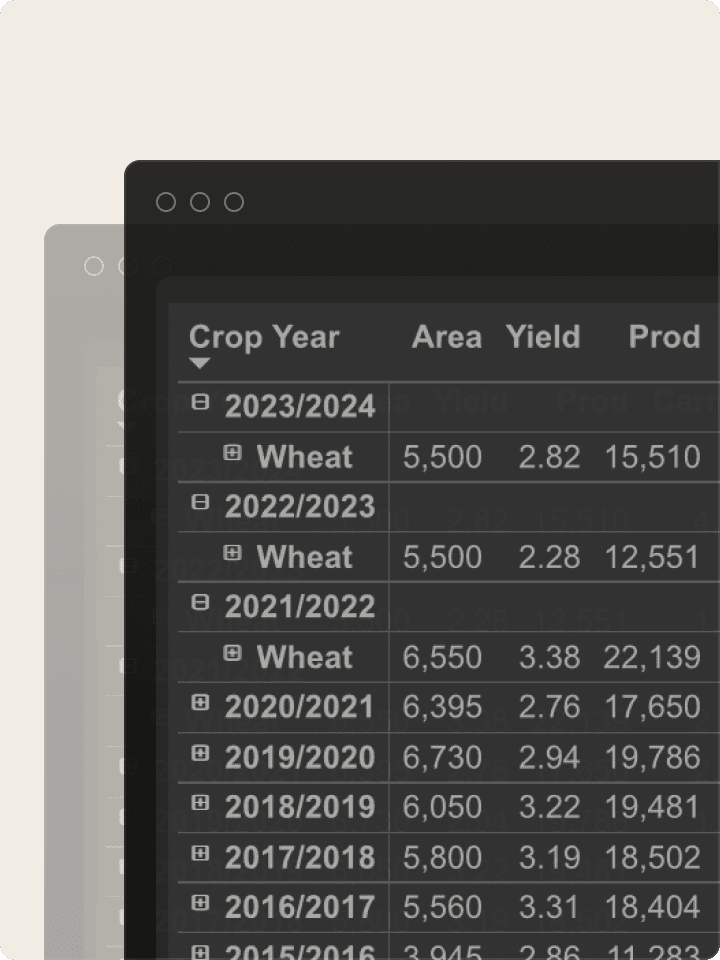

The complete CFR overview

With access to 3500 CFR prices across 590 destination ports, our CFR matrix empowers you to identify the optimal trading opportunities. By integrating our dataset of market prices with our vast amount of global freight rates, we have tailored a simple overview enabling you to compare origin competitiveness quickly.

Get started today - Trade with an edge!

Step 1

Start a trial - no commitment

Your time is valuable! We have made it simple and easy for you to try out CM Navigator for free or get a demo. No strings attached.

Step 2

Experience immediate value

The full potential of your trading game is now unlocked. Try out the full platform during your trial and experience the feeling of having the market at your fingertips.

Step 3

Stay in the lead

Be in the best position to compete with up-to-date; CFR Prices, Freights, Market Prices, Supply & Demand, Trade Flows, Funds Positions and Market Reports.

Explore Market Information

Freight

Freight Recap:

19/02/26

Feb 19, 2026

The dry bulk market opened the week with a generally subdued tone, influenced by ongoing Lunar New Year holidays in Asia and mixed regional sentiment. While the Atlantic basins showed pockets of resilience across segments, Asian activity remained muted with limited fresh enquiry and ample tonnage supply. Panamax displayed a clear Atlantic–Pacific divergence, and period interest provided selective support in both Panamax and Supramax. Broader market commentary points to firm grain exports and constructive expectations for Q1, particularly in Panamax and Capesize.

Commodities

Agri- Commodities:

09-13/02/26 Agri

Feb 17, 2026

The week started with prices mostly in the red, as the recent soybean rally appeared to lose momentum in a classic buy-the-rumor, sell-the-fact reaction. USDA confirmed private sales of 264k tons of US soybeans to China for 2025/26 delivery, yet prices still moved lower. Weekly US export inspections showed solid corn and wheat movement, while soybeans lagged on a year-on-year basis. Russian 12.5% wheat FOB values held steady at $231 for March shipment, acting as a headwind for MATIF amid a stronger euro.

Interview

Mads Frank Markussen on Sparta Market Outlook Podcast

Feb 12, 2025

Mads and the Sparta team explored the impact of Trump’s tariffs, sanctions, and market inefficiencies on oil and freight trading, as well as how tariffs on Mexico, Canada, and China could reshape trade flows—discussed